Crm software for financial services industry – The financial services industry is characterized by complex client relationships, stringent regulatory compliance, and a constant need for personalized service. Customer Relationship Management (CRM) software has become indispensable for firms navigating this challenging landscape. This comprehensive guide explores the vital role of CRM in financial services, detailing its features, benefits, and considerations for successful implementation. We’ll delve into specific functionalities, address common concerns, and highlight best practices to optimize your firm’s performance and client relationships.

Understanding the Unique Needs of Financial Services CRM

Unlike other industries, financial services demand a CRM system capable of handling sensitive data, complying with rigorous regulations, and facilitating complex transactions. Key requirements include:

- Data Security and Privacy: Robust security protocols are paramount to protect client information, complying with regulations like GDPR, CCPA, and industry-specific compliance standards (e.g., HIPAA for health insurance).

- Regulatory Compliance: The system must ensure adherence to KYC (Know Your Customer), AML (Anti-Money Laundering), and other relevant regulations, often requiring audit trails and detailed transaction logging.

- Client Relationship Management: Beyond basic contact details, the CRM should track interaction history, financial products held, risk profiles, investment preferences, and other crucial client data for personalized service.

- Sales and Marketing Automation: Automating lead generation, client onboarding, and marketing campaigns streamlines processes and enhances efficiency.

- Financial Product Management: The ability to manage product details, pricing, and associated documents within the CRM system is crucial for efficient sales and client service.

- Reporting and Analytics: Comprehensive reporting and analytics capabilities provide insights into sales performance, client behavior, and risk management, enabling data-driven decision-making.

- Integration with Existing Systems: Seamless integration with existing accounting software, portfolio management systems, and other crucial applications is essential for a unified workflow.

Key Features of a Robust Financial Services CRM

Client Management and Onboarding

A powerful CRM for financial services should streamline client onboarding, from initial contact to account setup. This includes:

- Lead Capture and Qualification: Efficiently capturing and qualifying leads from various sources.

- Automated Client Onboarding: Automating the process of collecting necessary documentation and setting up accounts.

- Centralized Client Profiles: Maintaining a complete and up-to-date view of each client’s information, financial history, and interactions.

- Client Communication Management: Managing all communications (email, phone calls, meetings) in a centralized location.

Sales and Marketing Automation

Automating sales and marketing tasks improves efficiency and enhances customer engagement:

- Lead Scoring and Prioritization: Identifying and prioritizing high-potential leads based on pre-defined criteria.

- Marketing Campaign Management: Planning, executing, and tracking marketing campaigns across multiple channels.

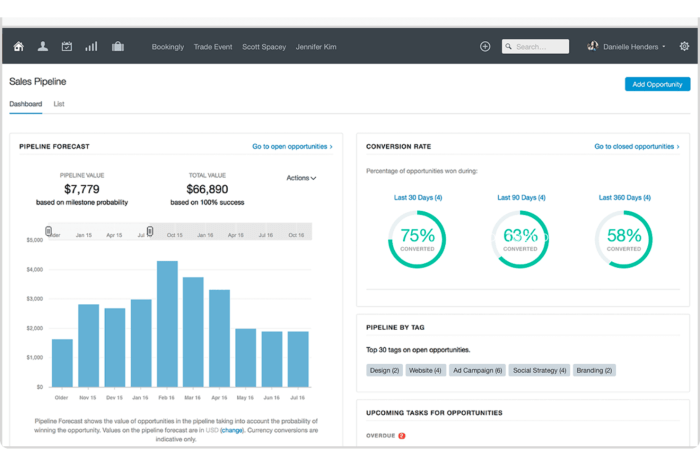

- Sales Pipeline Management: Visualizing and managing the sales process, tracking opportunities from initial contact to closure.

- Automated Reporting and Analytics: Generating reports on sales performance, marketing ROI, and other key metrics.

Compliance and Risk Management, Crm software for financial services industry

Ensuring regulatory compliance is crucial. A robust CRM should offer:

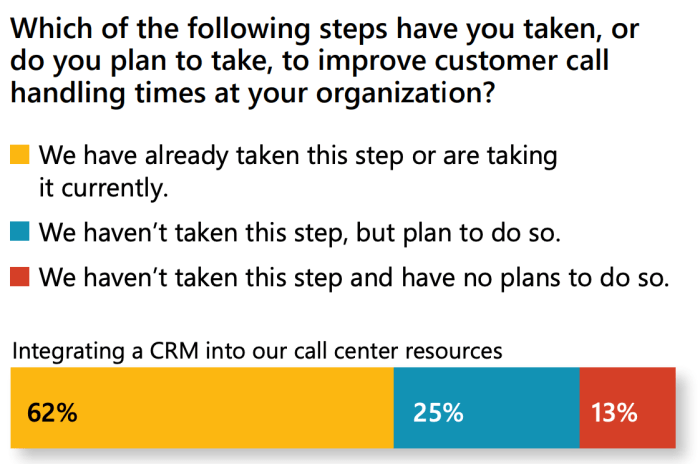

Source: aimultiple.com

- KYC/AML Compliance Tools: Facilitating compliance with Know Your Customer and Anti-Money Laundering regulations.

- Audit Trails and Logging: Maintaining detailed records of all actions and transactions for audit purposes.

- Data Encryption and Security: Protecting sensitive client data with robust security measures.

- Access Control and Permissions: Managing user access to sensitive data based on roles and responsibilities.

Reporting and Analytics

Data-driven decision-making is key. A comprehensive CRM provides:

- Customizable Dashboards and Reports: Generating reports on key performance indicators (KPIs) tailored to specific needs.

- Real-time Data Visualization: Gaining insights into sales performance, client behavior, and other crucial metrics.

- Predictive Analytics: Using data to predict future trends and opportunities.

Choosing the Right CRM for Your Financial Institution

Selecting the right CRM involves careful consideration of several factors:

- Size and Type of Institution: The needs of a small boutique firm differ significantly from those of a large multinational bank.

- Budget and Resources: CRM solutions range widely in price and complexity.

- Integration Capabilities: Ensure seamless integration with existing systems.

- Scalability and Flexibility: Choose a solution that can adapt to your evolving needs.

- Vendor Support and Training: Reliable vendor support and comprehensive training are essential for successful implementation.

Popular CRM Solutions for Financial Services: Crm Software For Financial Services Industry

Several leading CRM providers offer solutions tailored to the financial services industry. Research and compare options based on your specific requirements. Examples include Salesforce Financial Services Cloud, Microsoft Dynamics 365 for Finance, and specialized solutions from firms like Redtail Technology (for wealth management) and Wealthbox.

Frequently Asked Questions (FAQ)

- Q: What are the benefits of using CRM in financial services?

A: Benefits include improved client relationships, enhanced regulatory compliance, increased efficiency, better sales performance, and data-driven decision-making.

- Q: How much does a financial services CRM cost?

A: Costs vary widely depending on the size of your institution, the features required, and the chosen vendor. Expect a range from subscription-based models to substantial upfront investments for enterprise solutions.

- Q: How long does it take to implement a CRM system?

A: Implementation time depends on the complexity of the system and the size of your institution. Expect a timeframe ranging from several weeks to several months.

- Q: What are the key challenges in implementing a CRM in financial services?

A: Challenges include data migration, integration with existing systems, user adoption, and ensuring regulatory compliance.

- Q: How can I ensure data security and privacy with a CRM?

A: Choose a vendor with robust security protocols, including data encryption, access controls, and regular security audits. Ensure compliance with relevant regulations like GDPR and CCPA.

Conclusion

Implementing a robust CRM system is crucial for financial institutions seeking to thrive in today’s competitive environment. By carefully considering your specific needs, choosing the right solution, and prioritizing data security and regulatory compliance, you can leverage the power of CRM to enhance client relationships, streamline operations, and drive sustainable growth. Investing in the right CRM is an investment in the future of your firm.

Call to Action

Ready to transform your financial services firm with a powerful CRM? Contact us today for a free consultation and discover how we can help you find the perfect solution to meet your unique needs.

Source: revopsteam.com

Clarifying Questions

What are the key security considerations for CRM software in finance?

Security is paramount. Look for systems with robust encryption, access controls, and compliance with regulations like GDPR and CCPA. Regular security audits and penetration testing are also essential.

How can CRM improve client retention in financial services?

Source: isu.pub

CRM facilitates personalized communication and targeted service. By tracking client preferences and interactions, financial institutions can proactively address needs and anticipate potential issues, leading to increased loyalty and retention.

What is the typical cost of implementing a CRM system?

Costs vary widely depending on the size of the institution, the chosen software, and implementation services. Expect a range from initial software licensing fees to ongoing maintenance and support costs.

How long does it typically take to implement a CRM system?

Implementation timelines depend on the complexity of the system and the organization’s size. Smaller implementations might take a few months, while larger projects could extend to a year or more.